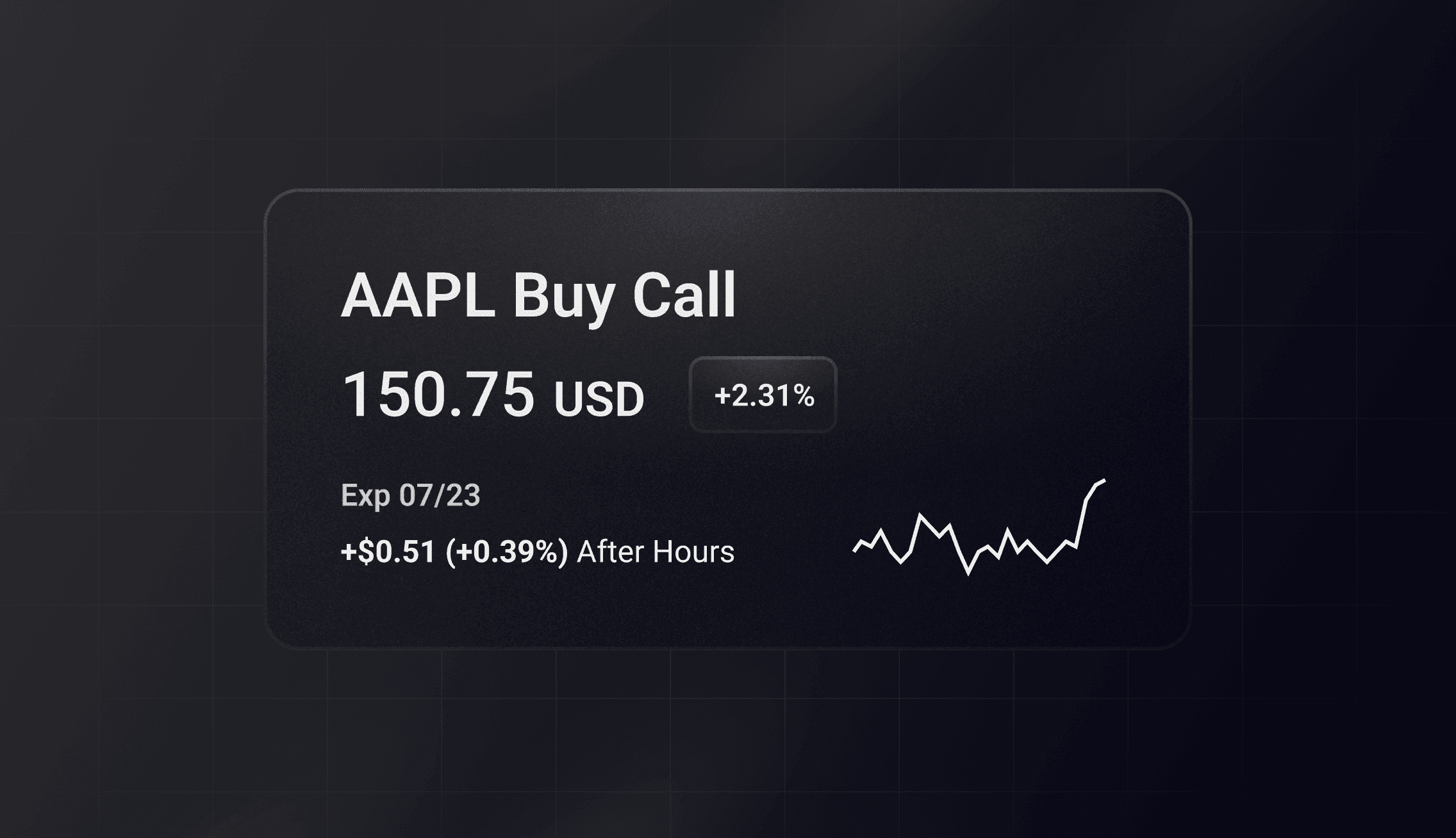

Build a 0-DTE Covered Call Screener for SPY with Polygon.io

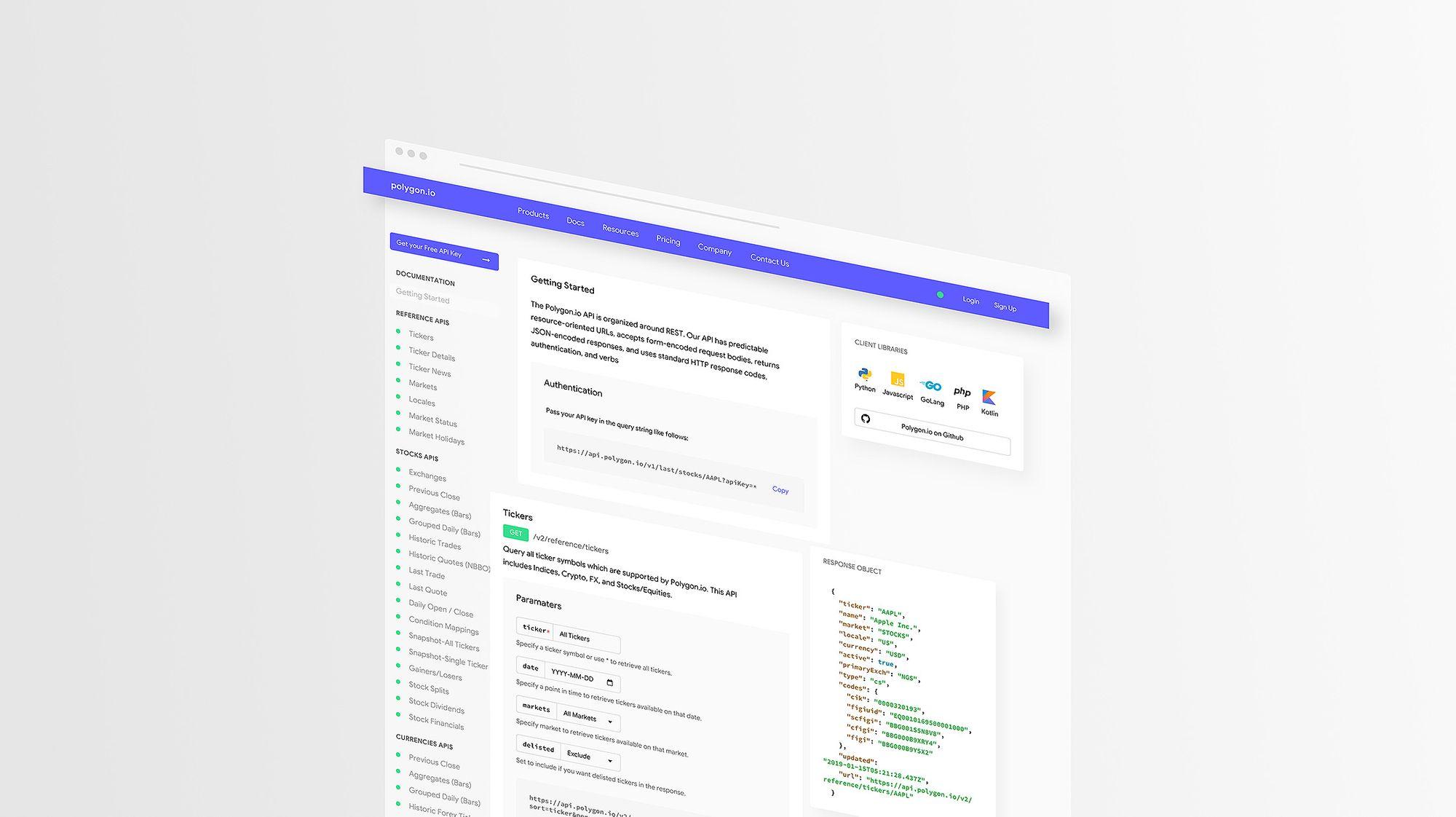

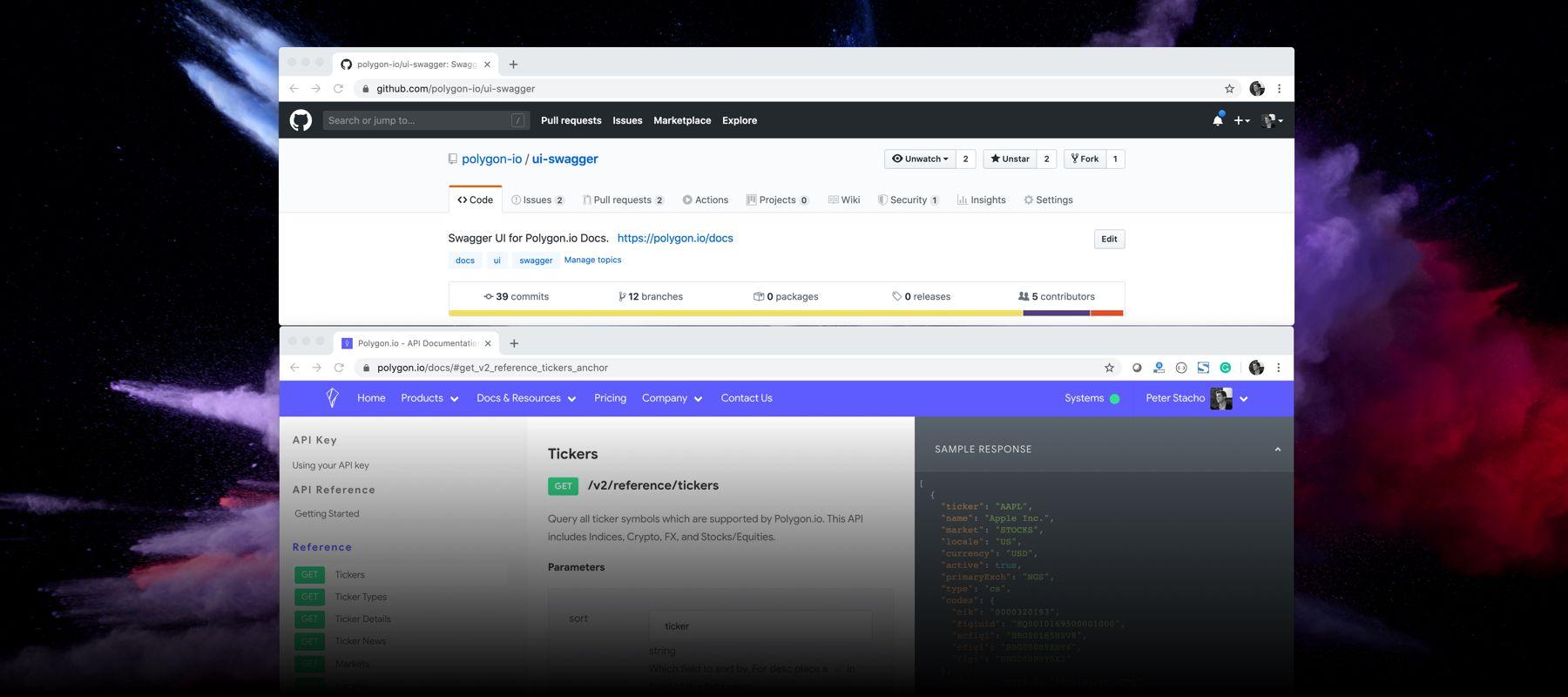

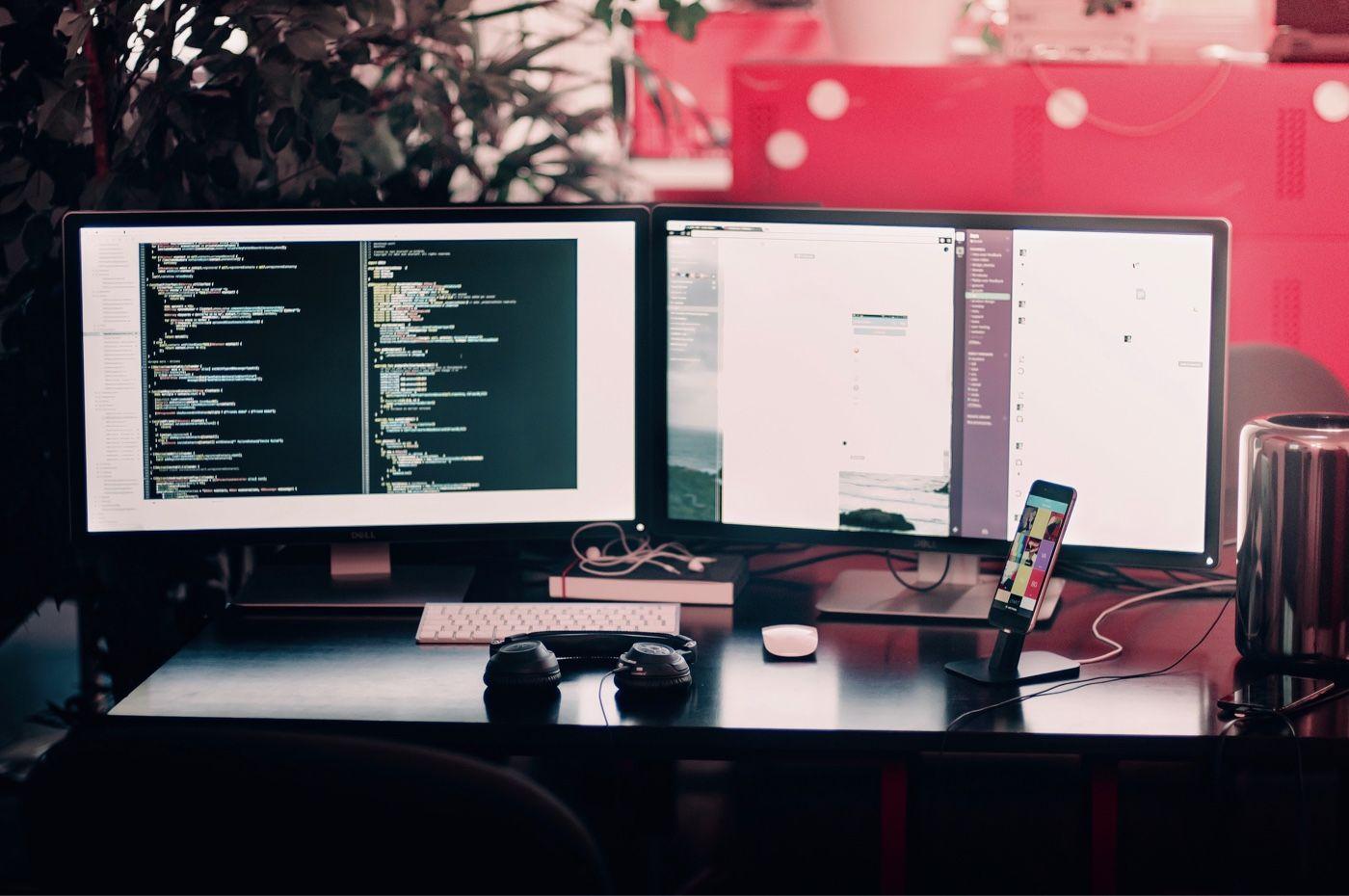

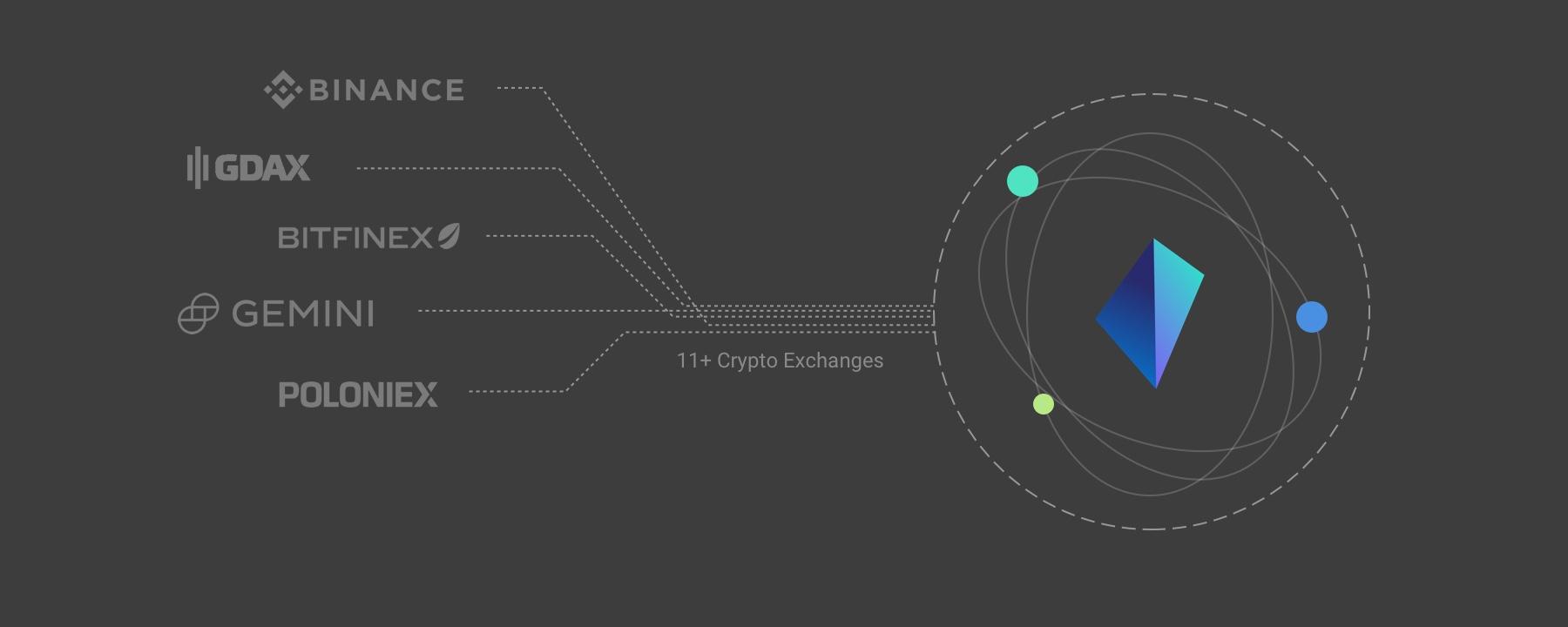

In this demo, we’ll build a small Python utility that pulls only the option contracts you’d consider for a covered call expiring today (0-DTE) on SPY. Along the way, we’ll explain not just what to do, but why each step matters—especially if you’re new to options or market data. Who this is for: developers comfortable with Python who want to automate an options workflow—even if you’re still learning options. You must have an Polygon Options Advanced plan for this demo to work properly. What

alexnovotny