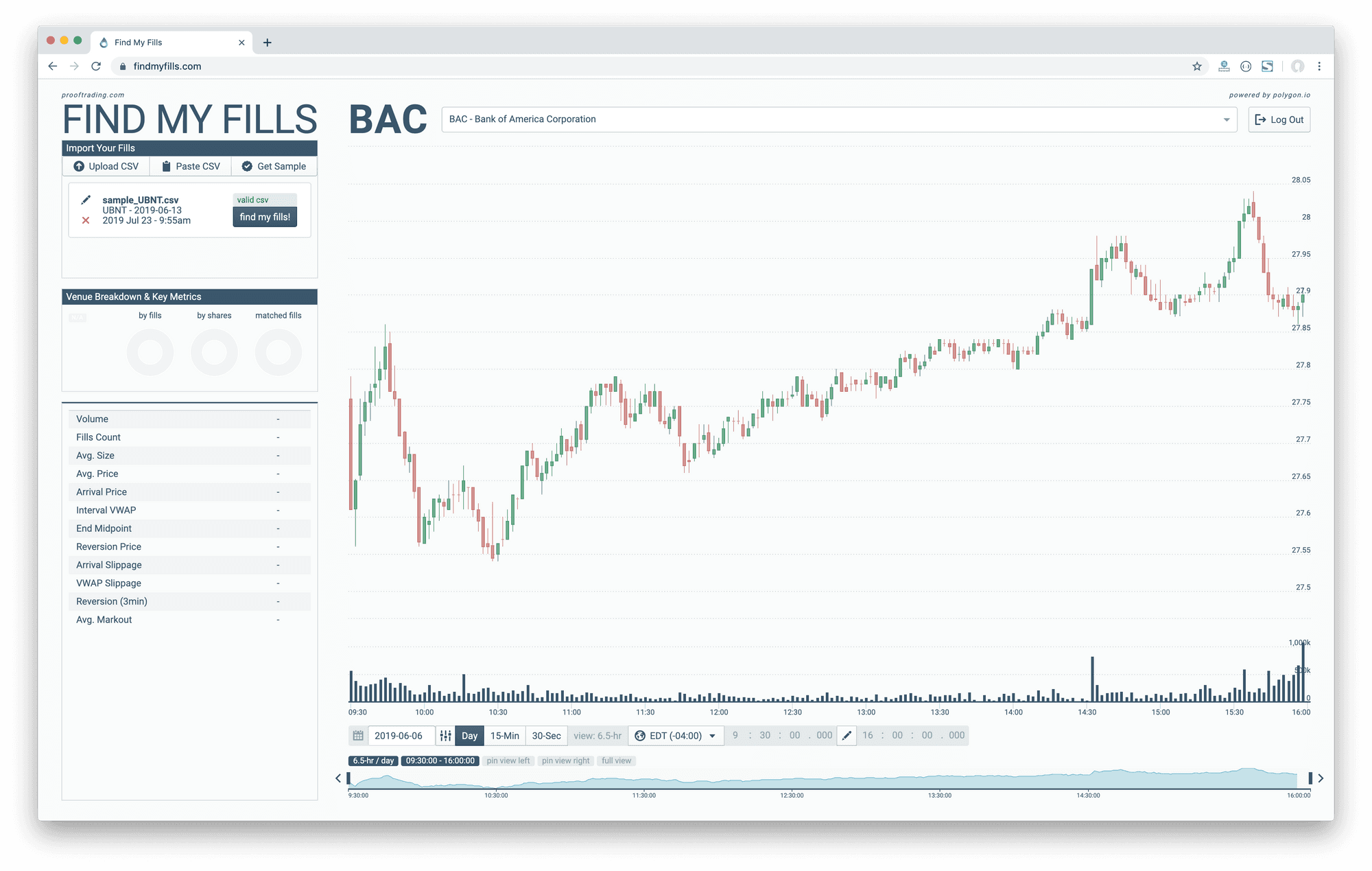

Integration: QuantConnect

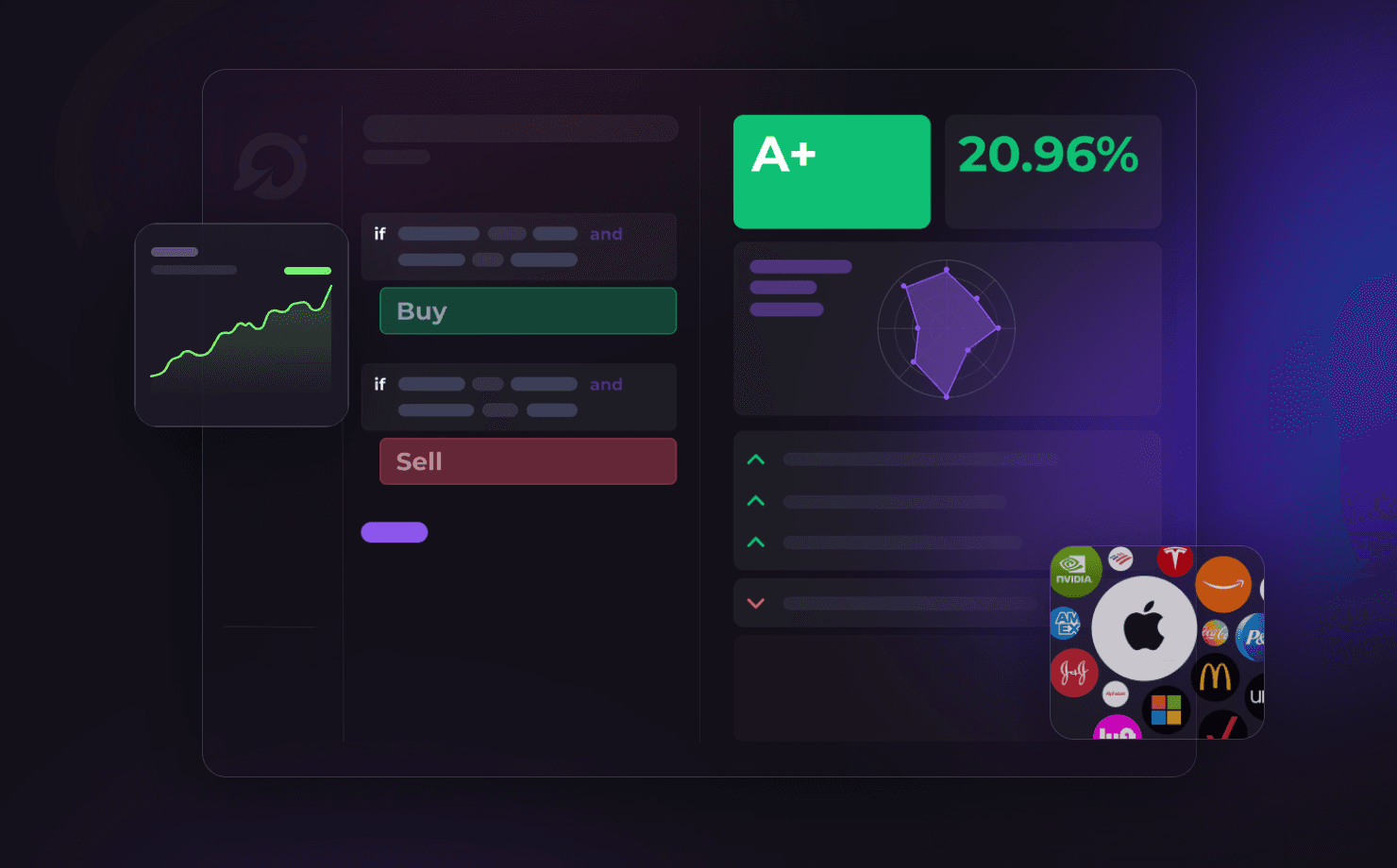

We are excited to announce our integration with QuantConnect! This offering empowers users with state-of-the-art research, backtesting, parameter optimization, and live trading capabilities, all fueled by the robust market data APIs and WebSocket Streams of Polygon.io.

jack