Introducing

Understanding the SIPs

Jun 15, 2020

At the core of the securities markets in the U.S. lies the Securities Information Processors (the “SIPs”). The history of SIPs goes back to 1975 when Congress established the concept as part of its 1975 amendments to the Securities Exchange Act of 1934 (the “Exchange Act”) to help establish a national market system for the trading of securities. The SIPs essentially link the U.S. markets by processing and consolidating all bid/ask quotes and trades from every exchange (i.e., core data) into one data feed.

As required by Regulation National Market System (“Regulation NMS”), which was introduced in 2005 to modernize and strengthen the national market system, every broker-dealer in the US is required to report their best bids and offers to the securities exchanges. The securities exchanges consolidate this information from the broker-dealer and provide it to the SIPs to create the consolidated data. Every broker-dealer is then required to purchase the consolidated data from the SIPs to comply with their best execution obligations and compete in the market.

This regulatorily mandated process of data reporting and consolidating makes it such that the data that the SIPs disseminate is not available anywhere else leading Congress to recognize the SIPs as public utilities in effect. As such, Congress has stated that one of the responsibilities of the SEC is “to preserve the integrity and affordability of the consolidated data stream” that comes from the SIPs. Each SIP is governed by its national market system plan that includes the respective fees for the market data and is approved by the SEC in part to ensure that the fees are fair, reasonable, and not unreasonably discriminatory.

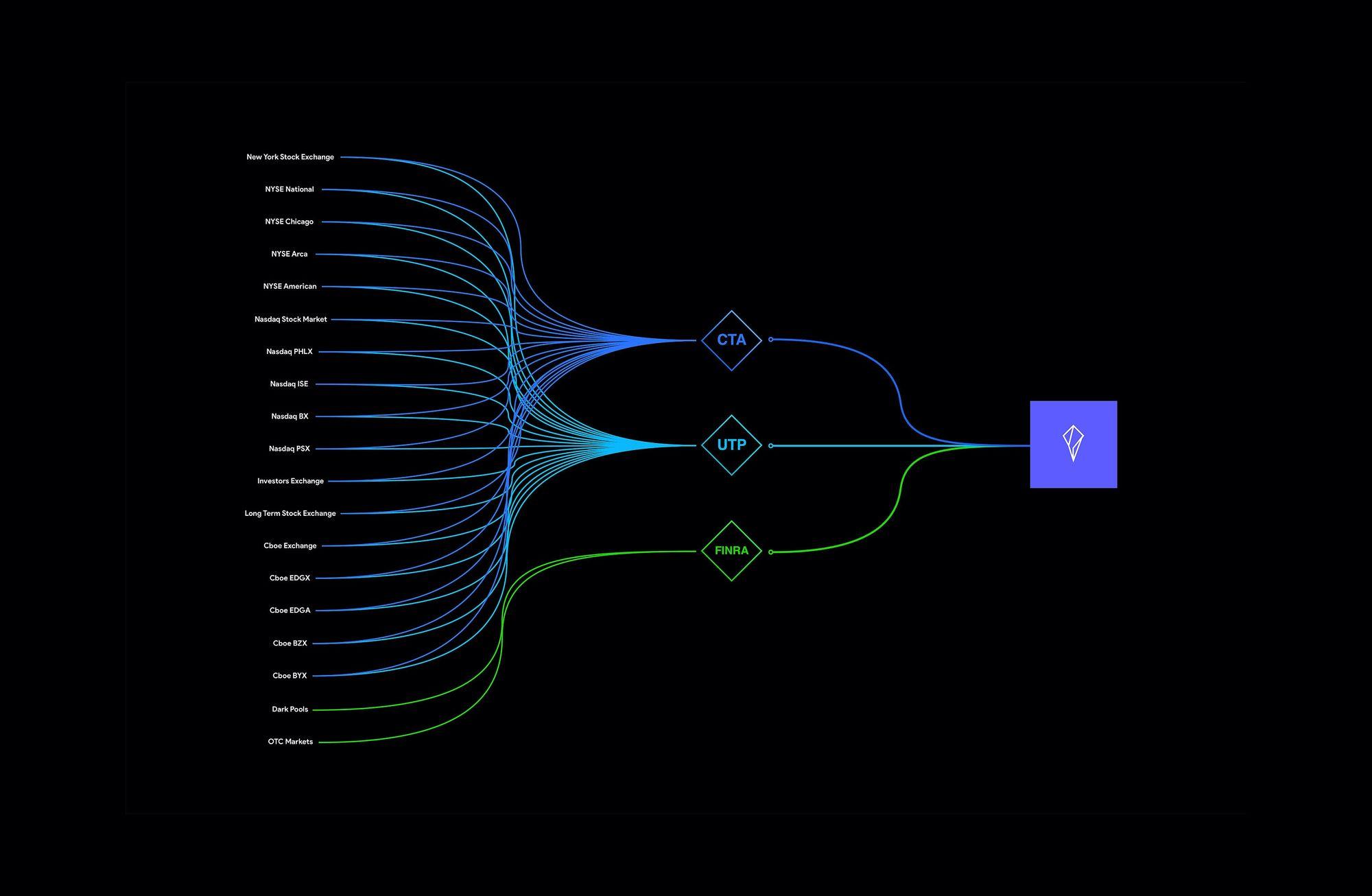

Today, there are three SIPs: the Consolidated Tape Association (“CTA”), the Unlisted Trading Privileges (“UTP”), and the Option Price Reporting Authority (“OPRA”). CTA is administered by NYSE and is the exclusive processor for securities listed on NYSE (Network A) and on several other exchanges, including those affiliated with NYSE (Network B). UTP is administered by Nasdaq and does the same as CTA but for Nasdaq-listed securities (Network C). OPRA, which is administered by the Chicago Board Options Exchange (“CBOE”), aggregates and disseminates consolidated last sale and quotation information for exchange-traded options.

Polygon.io and the SIPs

At Polygon, we receive data directly from the three SIPs as binary feeds rather than via retransmission or through an intermediary. Not only does this reduce latency, it allows for the unquestionable accuracy and guaranteed integrity of each and every transaction across the entire market. Our Stocks API and our Options API normalize the data into one easy to use and access source, and gives users 100% of the market volume available in the United States at any given time. By gathering data directly from the SIPs, we are able to provide our customers with a complete picture of the U.S. equities and options market.