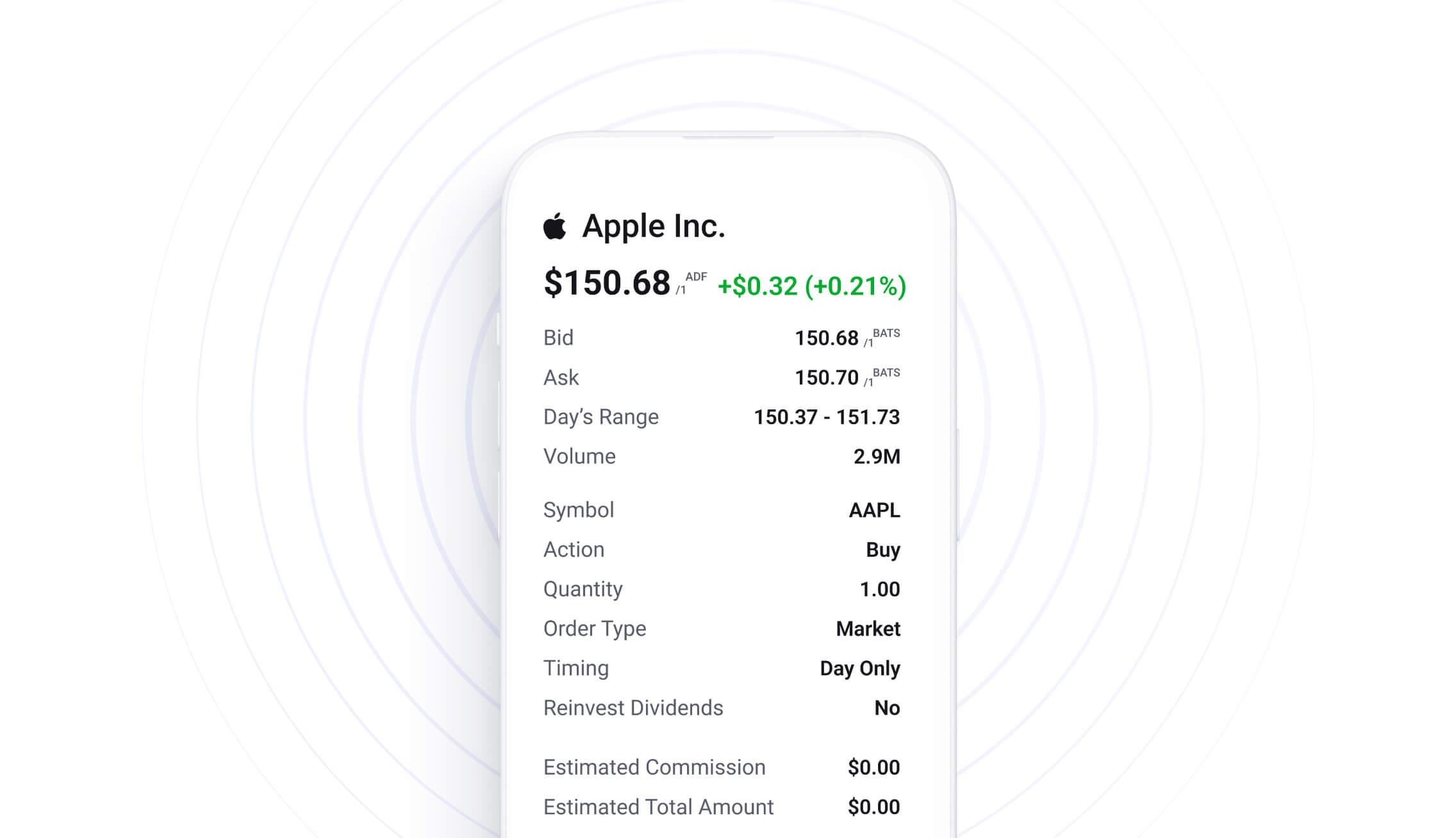

Vendor Display Rule

Broker-dealers need to use full SIP data on screens where trades can be implemented. FINRA may impose fines if the Vendor Display Rule isn't followed.

stan

More posts in faq

Broker-dealers need to use full SIP data on screens where trades can be implemented. FINRA may impose fines if the Vendor Display Rule isn't followed.

stan

Sometimes users reach out to us confused about why they receive an aggregate bar late or twice through our WebSocket feed. This behavior is intentional and designed for quality assurance purposes on our end, here’s why: Trades are occasionally sent to us late. FINRA, for example, has up to 15 minutes to report a trade that happened on any of the dark pools. We deal with these delayed trades differently for second and minute aggregates. Second Aggregation: For sec

jack

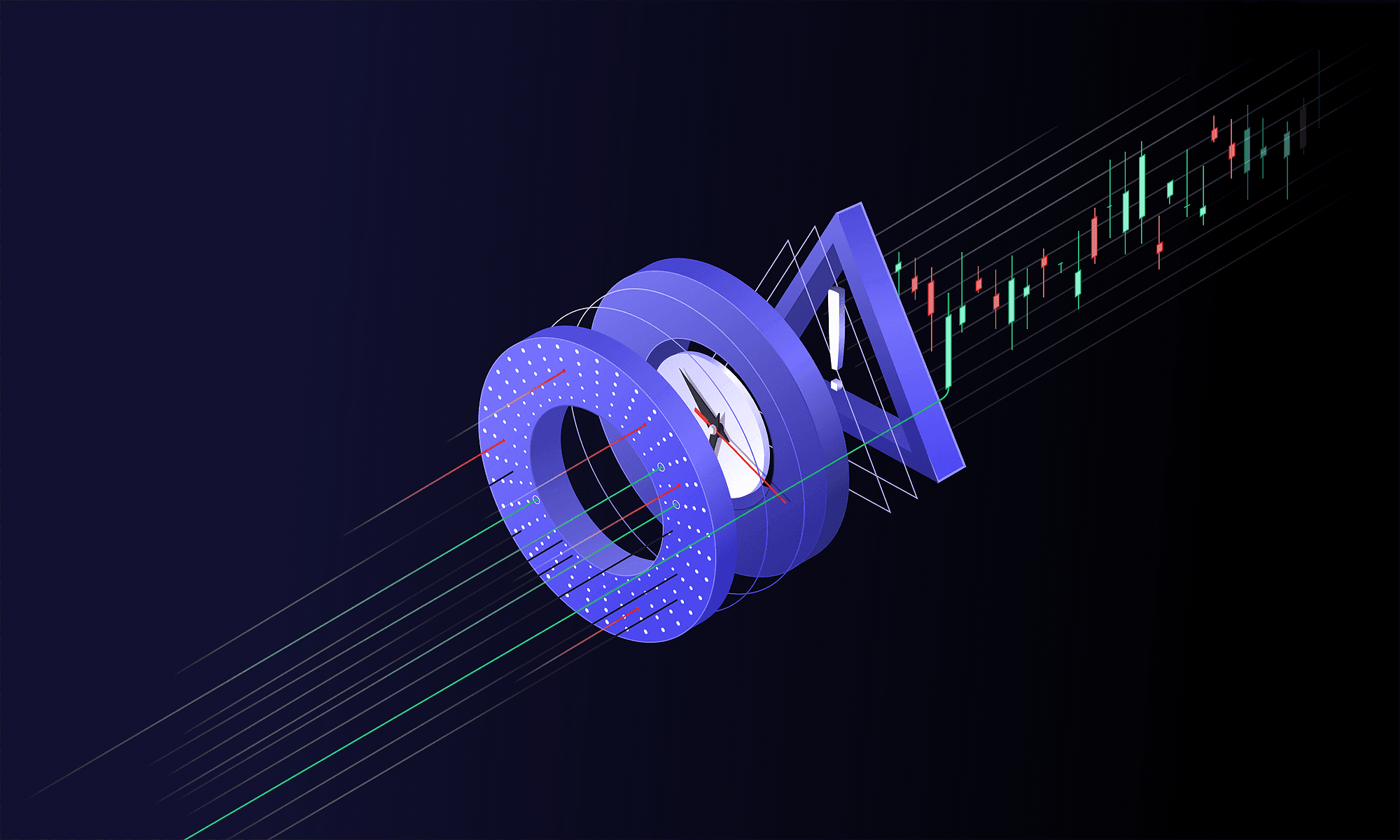

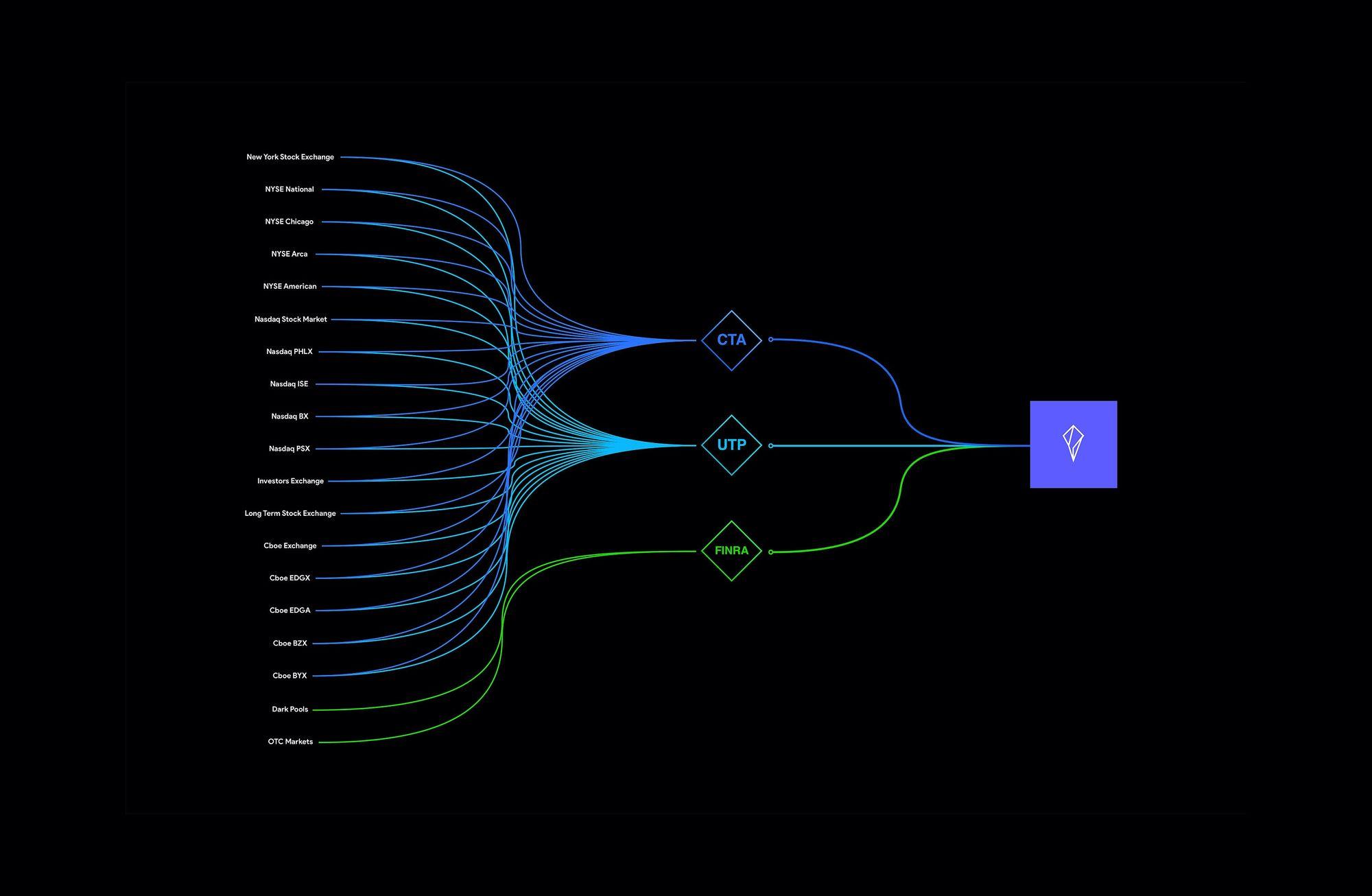

At the core of the securities markets in the U.S. lies the Securities Information Processors (the “SIPs”). The history of SIPs goes back to 1975 when Congress established the concept as part of its 1975 amendments to the Securities Exchange Act of 1934 (the “Exchange Act”) to help establish a national market system for the trading of securities. The SIPs essentially link the U.S. markets by processing and consolidating all bid/ask quotes and trades from every exchange (i.e., core data) into one

peter

Many major exchanges, trading venues, regulatory bodies, and other data providers require data vendors like Polygon to collect and maintain specific personal and employment information from subscribers accessing certain market data. This is necessary to determine whether a user qualifies as a Professional Subscriber or a Non-Professional Subscriber. Accurate classification is essential. Providing complete and truthful information helps ensure uninterrupted access to Polygon’s services and avoid

peter

Aggregates ( OHLCV ) are a little more complex to calculate than just min,max,sum. There are condition matrix tables you must adhere to in the CTA and UTP specifications.

polygonteam