Introducing

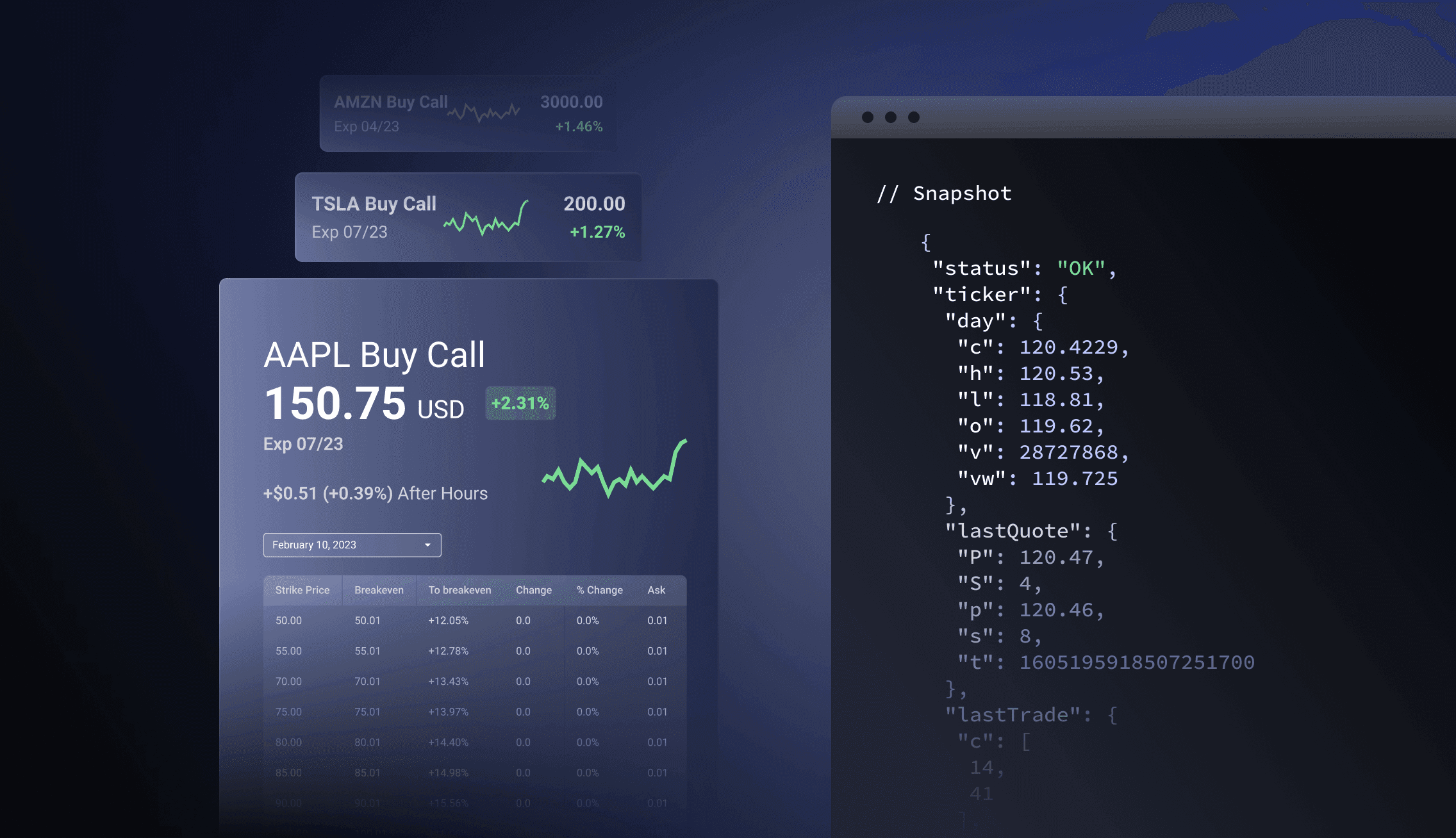

Introducing Options Chain Snapshot API

Feb 9, 2023

Level up your trading game by getting the most up-to-date price data for an asset's entire options chain in a single API call. Sort and filter by every aspect of an options contract. Get the latest price changes, greeks, and implied volatility for each option in the chain, delivered through a lightening fast API.

Our new Options Chain Snapshot API makes it easy to get every active option for a given security, or filter for just the contracts you need by specifying strike price, expiration date, or contract type. Strike price and expiration date use Query Filter Parameters to support searching with inequalities, so you can easily search for values greater than/equal to, less than/equal to, or combine them to get only a specific range.

Use our new Options Chain Snapshot API to tune your trading strategy or build visualizations of the options chain for a given stock, etf, or index.

The following example shows querying the new endpoint for AAPL calls with a $250 strike price expiring in 2025. Only 3 Apple contracts matched our requirements, expiring in January, June, and December 2025. We get the most recent data on premiums for each contract, open interest, greeks, implied volatility, as well as information on the contract's performance for today's trading session. We've also subscribed to real-time stock data so we can see the latest price for AAPL and the calculated change to break even on each contract.

https://api.polygon.io/v3/snapshot/options/AAPL?strike_price=250&expiration_date.gte=2025-01-01&contract_type=call&apiKey=<YOUR API KEY>

{

"results": [

{

"break_even_price": 252.06,

"day": {

"change": -0.08,

"change_percent": -3.94,

"close": 1.95,

"high": 1.98,

"last_updated": 1675123200000000000,

"low": 1.95,

"open": 1.98,

"previous_close": 2.03,

"volume": 3,

"vwap": 1.96

},

"details": {

"contract_type": "call",

"exercise_style": "american",

"expiration_date": "2025-01-17",

"shares_per_contract": 100,

"strike_price": 250,

"ticker": "O:AAPL250117C00250000"

},

"greeks": {

"delta": 0.09979537480718394,

"gamma": 0.0035944750859658527,

"theta": -0.007100109992341934,

"vega": 0.3534727717962465

},

"implied_volatility": 0.24132326457696568,

"last_quote": {

"ask": 2.22,

"ask_size": 627,

"bid": 1.9,

"bid_size": 200,

"last_updated": 1675183059055012000,

"midpoint": 2.06,

"timeframe": "REAL-TIME"

},

"open_interest": 5823,

"underlying_asset": {

"change_to_break_even": 108.483,

"last_updated": 1675182682892125400,

"price": 143.5768,

"ticker": "AAPL",

"timeframe": "REAL-TIME"

}

},

{

"break_even_price": 253.175,

"day": {

"change": -0.08,

"change_percent": -2.52,

"close": 3.1,

"high": 3.1,

"last_updated": 1675123200000000000,

"low": 3.1,

"open": 3.1,

"previous_close": 3.18,

"volume": 1,

"vwap": 3.1

},

"details": {

"contract_type": "call",

"exercise_style": "american",

"expiration_date": "2025-06-20",

"shares_per_contract": 100,

"strike_price": 250,

"ticker": "O:AAPL250620C00250000"

},

"greeks": {

"delta": 0.13470005212187042,

"gamma": 0.004075945437391387,

"theta": -0.008322163844099655,

"vega": 0.38133386922450285

},

"implied_volatility": 0.2423458539823752,

"last_quote": {

"ask": 3.25,

"ask_size": 556,

"bid": 3.1,

"bid_size": 115,

"last_updated": 1675183513083289900,

"midpoint": 3.175,

"timeframe": "REAL-TIME"

},

"open_interest": 1645,

"underlying_asset": {

"change_to_break_even": 109.598,

"last_updated": 1675182682892125400,

"price": 143.5768,

"ticker": "AAPL",

"timeframe": "REAL-TIME"

}

},

{

"break_even_price": 255.1,

"day": {

"change": 0.05,

"change_percent": 1.053,

"close": 4.8,

"high": 5.13,

"last_updated": 1675123200000000000,

"low": 4.65,

"open": 4.95,

"previous_close": 4.75,

"volume": 491,

"vwap": 4.8237

},

"details": {

"contract_type": "call",

"exercise_style": "american",

"expiration_date": "2025-12-19",

"shares_per_contract": 100,

"strike_price": 250,

"ticker": "O:AAPL251219C00250000"

},

"greeks": {

"delta": 0.1835241262196211,

"gamma": 0.004442353857886379,

"theta": -0.009527547492665517,

"vega": 0.7051926099669936

},

"implied_volatility": 0.24426447525599448,

"last_quote": {

"ask": 6.1,

"ask_size": 1,

"bid": 4.1,

"bid_size": 1,

"last_updated": 1675183480418019600,

"midpoint": 5.1,

"timeframe": "REAL-TIME"

},

"open_interest": 82,

"underlying_asset": {

"change_to_break_even": 111.523,

"last_updated": 1675182682892125400,

"price": 143.5768,

"ticker": "AAPL",

"timeframe": "REAL-TIME"

}

}

],

"status": "OK",

"request_id": "6e0f598b5cd205ef71f566060c38ee5b"

}

Access to our Snapshot API is enabled with an Options Starter subscription or above, with more granular data available in the responses of higher tiered plans. Unlock response attributes for the underlying asset such as price and change to break even by combining your options plan with a subscription to our Stock API.

We think our new Options Chain Snapshot API will help you make faster and more informed decisions about options trades. Head over to the docs to try it out for yourself.